Estimated reading time: 12 minutes

What sets millionaires apart from the rest when it comes to building wealth? It’s not just about earnings, it’s their daily habits. In this article, we focus on the practical and strategic habits of millionaires that you can incorporate into your own life to advance your financial goals. Explore how effective financial management, strategic networking, and continuous learning can elevate your wealth-building efforts.

Table of contents

Key Takeaways

Get your head in the game: Millionaires nurture a millionaire mindset that thrives on growth, squashes limiting beliefs, and is goal-oriented. Set those goals, make ‘em clear, and get ready to hustle!

Cash management is king: Our well-off wizards are pros at financial management, starring in roles like budgeting whizzes, investment doyens, and debt destroyers. Keep your expenses lower than a limbo stick at a beach party!

Master the art of time and people: Millionaires boost their bank accounts by valuing time like vintage wine, delegating like monarchs, and networking like social butterflies. Remember, your squad plays a huge role in your financial saga!

Cultivating a Millionaire Mindset

Building wealth starts within. Yes, you heard it right. It’s all about cultivating a millionaire mindset. Most millionaires adopt millionaire success habits designed specifically to align their behaviors with future financial goals. The legendary business coach and fellow entrepreneur, Dean Graziosi, takes us through the journey of self-made millionaires, highlighting their commitment to millionaire success through continuous change and improvement.

These successful individuals spend considerable time learning from a variety of sources, from self-help books to wealth management literature. It’s about simplifying the path from their current state to their millionaire status. So, are you ready to embrace your journey to live rich?

Embracing a Growth Mentality

Embracing a growth mentality is one of the fundamental success habits that self-made millionaires abide by. Having a growth mindset fosters adaptability, which in turn is key to financial success. Instead of sticking to traditional methods, they experiment with new strategies. This hands-on approach provides invaluable experience and expertise, which ultimately contributes to building wealth.

They view every life challenge as an opportunity for learning. From staying updated on new investing trends to learning new business strategies, their pursuit of knowledge is relentless. They believe in the power of learning and see it as an investment in their future.

Overcoming Limiting Beliefs

Limiting beliefs about money, often rooted in childhood experiences, can prevent us from reaching our financial potential. Fear and anxiety about financial matters, linked to previous negative experiences, can affect current financial decisions. But millionaires have mastered the art of overcoming these limiting beliefs.

By recognizing and confronting personal money blind spots, they stop self-sabotaging financial behaviors. They rewrite their financial story from a pessimistic outlook to an optimistic one, enabling more opportunities for creating wealth. So, what’s your financial story?

Setting Clear Goals

Setting clear, specific, and measurable financial goals acts as a roadmap for wealth building. Millionaires understand that goal setting is a deliberate and precise process that guides their financial decision-making. They’re detail-oriented in defining what financial success looks like, including timelines and milestones.

They use a variety of strategies to reach their financial goals, including:

Prioritizing objectives

Aligning their actions accordingly

Regular reviews

Employing tactics like visualization

These strategies help maintain focus.

So, what’s your one shining goal?

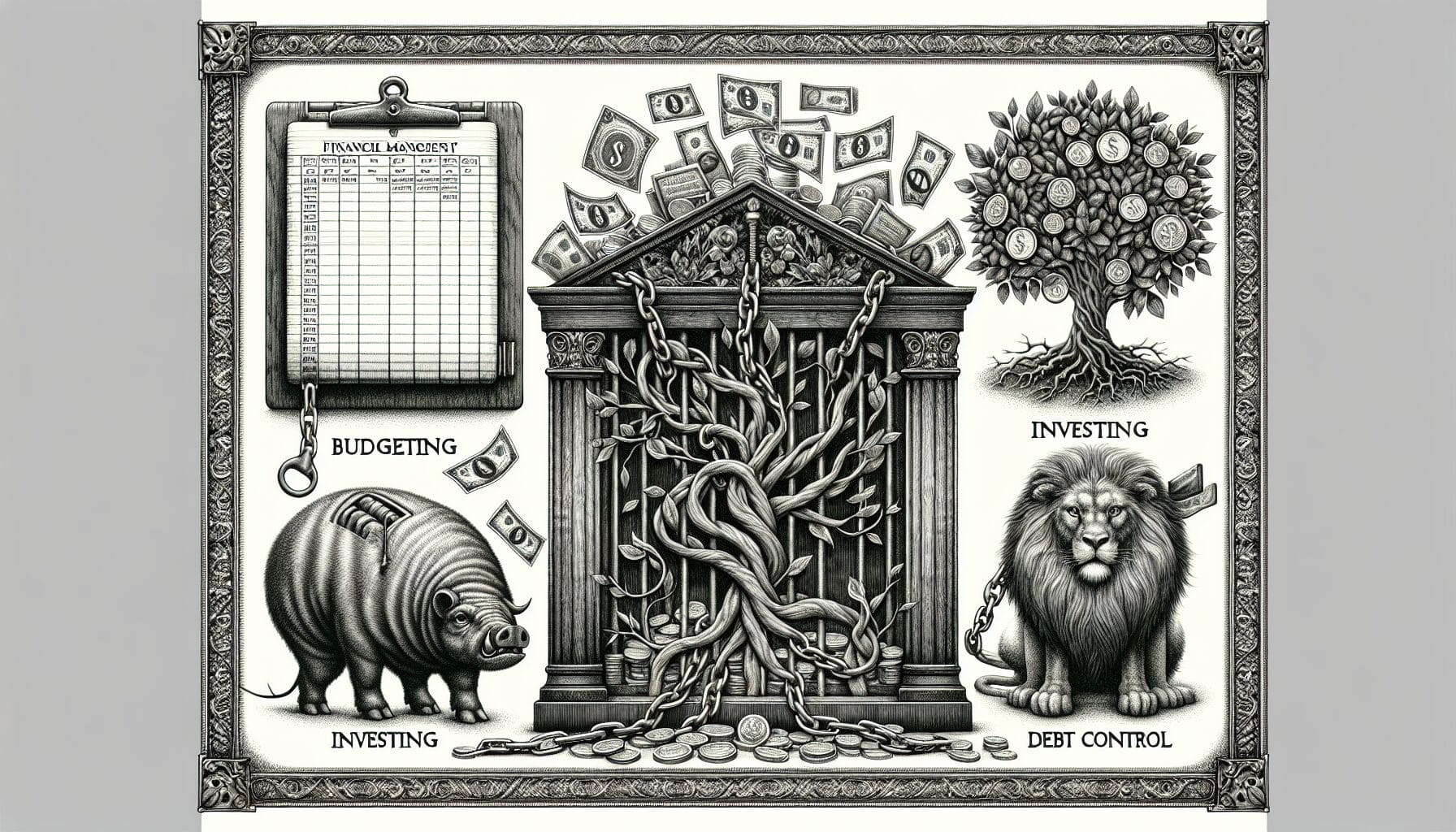

Mastering Financial Management

If cultivating a millionaire mindset is the seed of wealth building, then mastering financial management is the water that helps it grow. Millionaires are adept at managing their money. Regularly reviewing and managing their budgets, they ensure their living expenses are always less than their income.

They adopt a strategic approach to handle debt, emphasizing the reduction and avoidance of high-interest consumer debt. Paying down debts, particularly those with higher interest rates, is a priority for them. The ultimate goal? To become debt-free, a cornerstone of financial freedom.

Budgeting and Expense Tracking

Budgeting and expense tracking are key to effective financial management. Millionaires design their budgets with a clear goal – wealth accumulation. They don’t just track their spending; they scrutinize it to avoid overspending and unnecessary expenditures.

They increase their savings by prioritizing essential expenditures and minimizing spending on luxury items. This disciplined approach towards spending aids them in saving towards key financial goals such as retirement, emergencies, or significant purchases. So, how disciplined is your spending?

Investing Wisely

Investing is more than just a habit for millionaires; it’s an integral part of their wealth-building strategy. They diversify their investments with a mix of:

Stocks

Bonds

Mutual funds

ETFs

Other securities

This helps to mitigate risk. A significant portion of their income is reserved for investments, focusing on long-term gains in a diversified portfolio.

They favor low-risk investments as a strategy to protect their capital and build an emergency fund. And when the market dips, they pounce on the opportunity to purchase undervalued stocks or funds. Ready to make your money work for you?

Controlling Debt

Debt can be a wealth killer if not managed properly. Millionaires understand this and avoid unnecessary debt except for strategic ones, such as home mortgages. They prioritize eliminating high-interest debt quickly, often paying off credit cards in full each month to prevent accruing interest.

Maintaining a good credit score is another part of their strategy. A high credit score, preferably 720 or above, helps in securing loans or credit cards with the best possible interest rates. So, are you ready to take control of your debt?

Prioritizing Time and Energy

Time is money. And energy? Well, it’s the fuel that drives money-making endeavors. Millionaires understand the value of both. They adopt productive habits to phase out distractions and non-productive behaviors from their daily routines. They concentrate their time on activities that increase their income and wealth, such as cultivating relationships, investing in education, and focusing on tasks with revenue potential, which is how millionaires spend their resources wisely.

By leveraging tools like AI, they enhance their productivity, freeing up time to engage in more high-value tasks. So, are you ready to reclaim your time and energy?

Focusing on High-Impact Tasks

Focusing on high-impact tasks is a game-changer. Millionaires prioritize tasks that have the highest potential for revenue generation and business growth. Strategic growth initiatives are examples of high-impact tasks that lead to increased revenue.

To optimize their productivity, successful individuals, unlike the average person, tend to:

Schedule low-priority activities during their off-peak work hours

Adopt dietary habits such as intermittent fasting to maintain mental clarity and prevent energy dips

Incorporate regular exercise into their fitness routines, which is linked to an average 13% increase in income.

Are you ready to focus on tasks that truly matter?

Delegating Responsibilities

Delegation is a millionaire’s best friend. It helps them avoid burnout and free up time for more high-value tasks. They delegate tasks like data entry and bookkeeping to concentrate on client interaction and business growth. Outsourcing administrative tasks to specialists helps them save time and costs, aiding business scalability.

By assigning responsibilities, they empower their teams, resulting in improved task execution within their companies. Effective delegation is characterized by:

Providing clear directions

Providing the right tools

Trusting the team members

Selecting the appropriate individual for the job

Leveraging technology to automate repetitive tasks

Freeing up time for personal client interactions

Maintaining work-life balance

Ready to delegate and grow?

Balancing Work and Personal Life

Work-life balance isn’t just a buzzword for millionaires; it’s a way of life. Delegating tasks effectively helps them lower stress and prevent role overload, which could negatively impact their well-being. By maintaining a balanced life, they concentrate on:

producing high-quality work

prioritizing their health and well-being

spending time with family and friends

pursuing hobbies and interests

This allows them to focus on what truly matters and achieve success in all areas of their life.

After all, it’s not just about living to work, but also working to live a fulfilling life.

Building a Powerful Network

Ever heard the saying, “Your network is your net worth”? Millionaires live by it. They nurture close friendships and seek the company of like-minded individuals, absorbing lessons from successful people and shielding against negative influences. A robust support system is crucial in managing a million-dollar portfolio, as it’s challenging to do it entirely on one’s own. Understanding the average net worth of their peers can also be a motivating factor for these individuals.

Genuine relationships offer support, guidance, and referrals, underpinning long-term success. They learn from their network’s collective wisdom and experience, often crediting it as a contributing factor to their wealth and success. Networking is a two-way street where exchanging knowledge and expertise empowers professional growth and aids in wealth building. So, are you ready to build your network?

Surrounding Yourself with Successful People

Building wealth isn’t a solo journey. Millionaires surround themselves with successful individuals to learn and gain insights that facilitate their own success. They actively participate in industry events and professional organizations, networking with the best in the business to build wealth.

By volunteering their time and expertise to causes and industry organizations, they enhance their reputation and contribute positively to their industry. So, who’s in your circle of influence?

Leveraging Connections for Opportunities

Networking isn’t just about making connections; it’s about leveraging them for opportunities. Effective networking is a key strategy for millionaires to meet new people, forge business connections, and discover avenues for advancing their endeavors. A well-maintained network can lead to access to valuable resources, reputation building, and the discovery of new business opportunities.

Mentorship within a network offers access to guidance from successful professionals, valuable for navigating through wealth-building challenges. So, are you ready to leverage your connections?

Giving Back and Mentoring

Giving back is a critical part of the journey to wealth. Millionaires understand the importance of mentorship and the value it provides in professional development. Through mentorship, they provide guidance and insights that can guide investment decisions.

So, are you ready to give back and guide others on their journey as a success coach?

Continuously Learning and Adapting

The financial landscape is always evolving, and so are millionaires. They understand the importance of continuously learning and adapting. It equips individuals with the skills and knowledge required to navigate the evolving financial landscape.

They stay informed, gain fresh insights, and improve operational efficiency through the adoption of new industry knowledge.

Staying Informed on Market Trends

Staying informed on market trends is crucial for making savvy investment decisions. Millionaires read industry news daily to stay informed on the current market landscape and strategic focus areas. They consume information from a variety of diverse sources to avoid bias.

Continuous learning enables individuals to stay current with evolving market trends, such as fluctuations in interest rates, stock market shifts, and economic health indicators. So, are you ready to keep your finger on the market’s pulse?

Seeking Professional Advice

No man is an island, especially when it comes to financial management. Millionaires understand the value of professional advice. Engaging with financial advisors provides a comprehensive strategy that includes investment, insurance, and estate planning, ensuring individual needs are met for long-term financial goals.

Financial experts play a critical role in helping investors maintain discipline, particularly during volatile market periods, vital for long-term investment strategies and avoiding costly mistakes. They navigate the complexities of wealth management, including disruptions from new technologies and changing regulatory environments, and minimize tax obligations. By doing so, they help investors gain a clearer understanding of their financial picture.

So, are you ready to seek professional advice?

Embracing Change and Innovation

Embracing change and innovation is the name of the game for millionaires. Adapting to innovations and changes in the economic environment is vital for long-term success. It requires a willingness to update and modify financial strategies as needed.

Technological innovation, like digital-first services and AI, is crucial for wealth managers to meet the evolving expectations of younger, tech-savvy investors. So, are you ready to embrace change and innovation?

Summary

There you have it – the top five essential habits of millionaire moguls. From cultivating a millionaire mindset to continuously learning and adapting, these habits are more than just routines. They’re a way of life that helps millionaires unlock their potential and build wealth. It involves a blend of mindset, discipline, and strategy that sets them apart.

But remember, it’s not just about the money. These habits are about building a life of financial freedom and personal fulfillment. So, are you ready to embark on your journey to wealth and success? Remember, the road to riches is paved with habits!

Frequently Asked Questions

The habit of millionaires is to prioritize long-term success over temporary pleasures, being frugal and intentional with their spending, and using debt wisely to build more wealth. So, remember, delayed gratification is the key!

Behaving like a millionaire is not just about the bank balance. Being fit, punctual, and well-presented, as well as appreciating the finer things in life, are key ways to exude prosperity and success in your daily life. And who knows? Maybe the bank account will catch up eventually!

Millionaires make sure to prioritize their health by exercising for at least 30 minutes daily, as suggested by the “Rich Habits” study by Tom Corley. So, lace up those sneakers and get moving!

Ninety percent of millionaires achieved their wealth through owning real estate, making it a cornerstone of financial success. So, if you want to join the millionaire club, real estate might be your golden ticket!

Millionaires manage their finances by budgeting, living within their means, and making smart investments to control debt and build wealth. It’s all about balance!